In 2025, numerous clients of Innovest Global Wealth experienced the remarkable potential of investing in well-regulated international funds, an asset class that is unfamiliar to many across the globe. Many funds backed by top-tier asset managers delivered remarkable yields, surpassing 30% for clients. One Fund truly stood out: The BlackRock Global World Mining Fund Class A2, which delivered an impressive 70.45% return for clients and significantly enhanced their overall portfolio growth. The Fund has captured the attention of financial advisors and savvy investors around the globe, and today, we are thrilled to share insights into the Fund and our projections for its future.

Key Details (as of early 2026)

- Fund Manager: BlackRock

- ISIN: LU0075056555

- Base Currency: USD

- Structure: Accumulating (no dividend payouts)

- Risk Profile: Medium-High (5/7)

- Top Sectors: Primarily Gold, Diversified Mining, Copper, and Steel.

- Our Advisory charges: Approximately 1% per annum for the portfolio or assets under advisement.

What is The BlackRock Global World Mining Fund Class A2?

The BlackRock Global Funds (BGF) World Mining Fund Class A2 USD (LU0075056555) is an actively managed equity fund classified under the sector equity natural resources, structured as a UCITS vehicle domiciled in Luxembourg, and managed by BlackRock (Luxembourg) S.A. It was founded on March 21, 1997 (with the A2 USD share class launching on March 24, 1997).

Where does the Fund invest?

Investment focus: the Fund invests primarily in listed mining and metals companies worldwide (producers and developers across precious and base metals and related businesses). It is an equity sector fund with concentrated exposure to mining/material companies.

The Fund invests globally, allocating at least 70% of its assets to equity securities of companies primarily engaged in mining and/or production of base and precious metals and minerals. It does not hold physical metals or gold. As of December 31, 2025, its top holdings included Barrick Gold Corp (7.31%), Agnico Eagle Mines Ltd (6.49%), Rio Tinto PLC (5.92%), Newmont Corp (5.72%), Vale SA (5.08%), Anglo American PLC (5.06%), Wheaton Precious Metals Corp (4.61%), Kinross Gold Corp (4.40%), Glencore PLC (4.28%), and AngloGold Ashanti PLC (3.96%), with a total of 49 holdings overall. The portfolio's price-to-book ratio was 2.67x, and its price-to-earnings ratio was 25.15x.

As an accumulating (A2) share class, it reinvests income, making it suitable for investors seeking long-term capital growth with a high risk appetite.

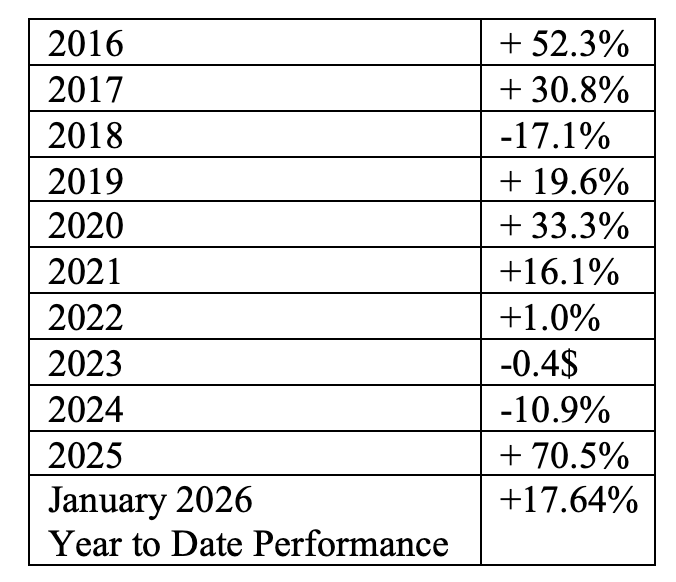

Historical performance (high-level summary, 1997 → to date)

Since the inception of the BlackRock Global World Mining Fund Class A2 on 24‑Mar‑1997, the cumulative return from 24‑Mar‑1997 to 31‑Dec‑2025 is +862.9%

The annualised Compound Annual Growth Rate (CAGR) since inception to 31‑Dec‑2025 is 8.19% p.a.

The performance of the fund for the last ten years is as follows;

The Compound Annual Growth Rate (CAGR) for the past ten years is 16.68% p.a.

Key Performance Drivers From 1997 to date

Period: 1997 - 2007 (Boom From Industrialisation)

· Driver: Rapid global industrial growth (notably China’s industrialisation) pushed strong demand for base metals (copper, iron ore) and energy‑related commodities.

· Effect: Mining revenues and valuations rose as commodity prices and volumes increased; developers expanded production.

Period: 2007–2009 (Global Financial Crisis)

· Driver: Global demand shock, collapsing commodity prices, sharp risk‑off, and tighter financing.

· Effect: Large falls in miner earnings and share prices; volatility and capital‑market stress reduced exploration and new projects.

Period: 2010–2014 (Post-Crisis Recovery And Commodity Downcycle)

· Driver: Initial post‑crisis recovery followed by slowing Chinese demand, oversupply in some metals, and weaker pricing.

· Effect: Mixed performance — some recovery years, then a prolonged bear phase for many commodities; many mining companies cut capital spending.

Period: 2015–2016 (Bottoming and Early Recovery)

· Driver: Sector restructuring, asset rationalisation, lower costs, and gradual demand stabilization.

· Effect: Strong rebound in mining equities as markets priced in recovery (2016 big positive return).

2017–2019 (Commodity Reflation And Consolidation)

· Driver: Renewed commodity strength (2017), followed by episodic weakness and consolidation in the industry; investors demanded capital discipline.

· Effect: Good returns in reflation years; volatility as investors rotated and priced execution risk.

2020–2021 (COVID Shock then Reflation)

· Driver: COVID‑19 produced supply disruptions, stimulus measures, and reflationary pressure; gold and many metals rallied; logistics and production shocks tightened markets.

· Effect: Strong gains for miners (2020–2021) as commodity prices and margins improved.

2022–2024 (Mixed/Flat to Negative)

· Driver: Macro tightening (higher rates), China demand variability, lower real‑rate support for gold at times, cost inflation, and company‑specific issues (operational misses, royalties/taxes).

· Effect: Modest/negative returns in several years — sector cyclical weakness and investor rotation into less cyclical assets.

2025 (Mineral Rallying Year)

· Driver: Large, multi‑metal rally (notably gold and key base/critical metals such as copper), tight physical markets, strong ETF/central‑bank flows into gold, and positive analyst revisions for copper/critical minerals tied to electrification. Fund’s concentrated exposure to major producers amplified gains.

· Effect: +70.45% calendar return for Class A2 USD (miners and mining indices also surged).

2026 (Impressive Start)

· Year-to-Date Performance: +17.96%. The Fund has achieved an impressive year-to-date return of 17.96%. We are optimistic that this positive trend will persist throughout the majority of the year.

The BlackRock Global World Mining Fund Class A2 Projections 2026 to 2030

To create projections for the BlackRock Global World Mining Fund Class A2, we will consider respectable analyst recommendations to develop conservative, base, and bull-case scenarios, aiming to provide a balanced outlook that inspires trust and optimism in the Fund's prospects.

Analyst Opinions on Gold, Copper, and Mining in General

The BlackRock Global World Mining Fund Class A2 focuses its investments mainly on Gold, Diversified Mining, Copper, and Steel sectors. Major financial institutions, including Bank of America and Citi, have raised their copper price projections for 2025–26, attributing this to ongoing supply constraints and rising demand driven by electrification. Several analysts continue to express optimism regarding copper's performance extending into 2026–2027.

The analysis and insights on precious metals in 2025 highlighted a remarkable surge in institutional and central bank demand for gold. Various reports emphasised gold's significant rise in 2025 and its sustained momentum heading into 2026.

The recent meetings in Davos 2026 may provide indirect support for the BlackRock Global World Mining Fund by improving investor confidence, expediting policy and corporate commitments that increase the demand for metals such as copper, lithium, nickel, rare earths, and to some degree, gold, as well as fostering financing and partnerships for mine development and supply-chain security. The impact is more structural and medium-term, rather than a sudden, significant increase to net asset value.

Therefore, for 2026 to 2030, our projections are as follows;

Conservative Projection: −15% to +15%

Base Projection: +5% to +25%

Bullish Projection: +25% to +60% (metal prices continue to run, central bank / ETF flows into precious metals persist, and miners deliver strong operational / margin upside).

Reasons behind projected outcomes (summary)

A) Upside drivers (supporting base/bull projections):

- Structural demand for critical metals (copper, lithium, nickel) from electrification and renewables; long lead times for new mines supply constraints.

- Elevated central‑bank purchases and ETF flows into precious metals (supporting gold), plus safe‑haven demand if macro/political uncertainty persists.

- Operational leverage of producers and disciplined capital allocation (dividends/ buybacks / fewer low‑return projects), which magnifies price moves into equity returns.

B) Downside / Risk factors that could lead to lower projections

- Faster‑than‑expected global growth (which reduces safe‑haven flows to gold) or a strong USD/real yields rising (bad for gold).

- Rapid easing of supply constraints or a large increase in mine supply projects would relieve prices.

- Company-specific operational failures, tax/royalty changes, or investor de-risking can hit mining equities harder than metals themselves.

In summary, Innovest Global Wealth is confident that the Fund will maintain robust performance in 2026, with a projected deceleration in 2027. Participants in the Fund can anticipate returns of at least 35% in 2026 and at least 18% in 2027. As of January 28, 2026, the Fund has achieved an impressive year-to-date return of 17.96%. We are optimistic that this positive trend will persist throughout the majority of the year.

If you are an experienced investor or a High Net Worth Individual interested in this Fund or similar opportunities, contact us at info@innovestglobalwealth.com or WhatsApp +256773488765. We can provide detailed insights and help you evaluate the potential benefits of investing in this promising fund.

Note: This article is for informational purposes only and should not be considered financial, legal, or tax advice. Some facts may have changed since publication.