The Central Provident Fund (CPF) is a crucial part of Singapore’s financial landscape, serving as the mandatory savings scheme designed to help residents build retirement, healthcare, and housing security.

But if you’re an expat wondering whether you need to contribute to CPF, or what happens to CPF when you leave Singapore, this guide covers:

- Does a foreigner need to contribute to CPF?

- Who is exempted from CPF contributions?

- What is the minimum amount to contribute to CPF?

- What happens to CPF at 55?

- What happens to CPF after 65?

- Can I withdraw CPF?

My contact details are hello@adamfayed.com and WhatsApp +44 7393 450 837, should you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Rest assured, I strive to keep the information accurate and up-to-date, but some facts may have changed since the time of writing.

Do expats have to pay CPF in Singapore?

It's important to note that expats and foreigners working in Singapore are exempt from paying CPF. This is a requirement only for Singapore Citizens and Permanent Residents (PRs).

Foreign employees under Employment Pass (EP), S Pass, or other work passes do not contribute to CPF.

However, employers have the flexibility to offer a private retirement or bonus scheme as part of the employee benefits package, giving you more control over your financial planning.

Who is eligible for CPF in Singapore?

You’re eligible for the Central Provident Fund if you are:

- A Singapore Citizen, or

- A Singapore Permanent Resident employed in Singapore under a contract of service.

Expats without PR status do not qualify for CPF contributions, though they can voluntarily contribute once they become PRs.

Who is exempted from paying CPF?

The following individuals are exempt from CPF contributions:

· Foreigners without PR status (including Employment Pass holders)

· Domestic employees who work 14 hours or less per week

· Employees of the United Nations (UN) or its affiliated agencies and institutions based in Singapore

· OECD employees working at Singapore’s International Energy Agency Centre.

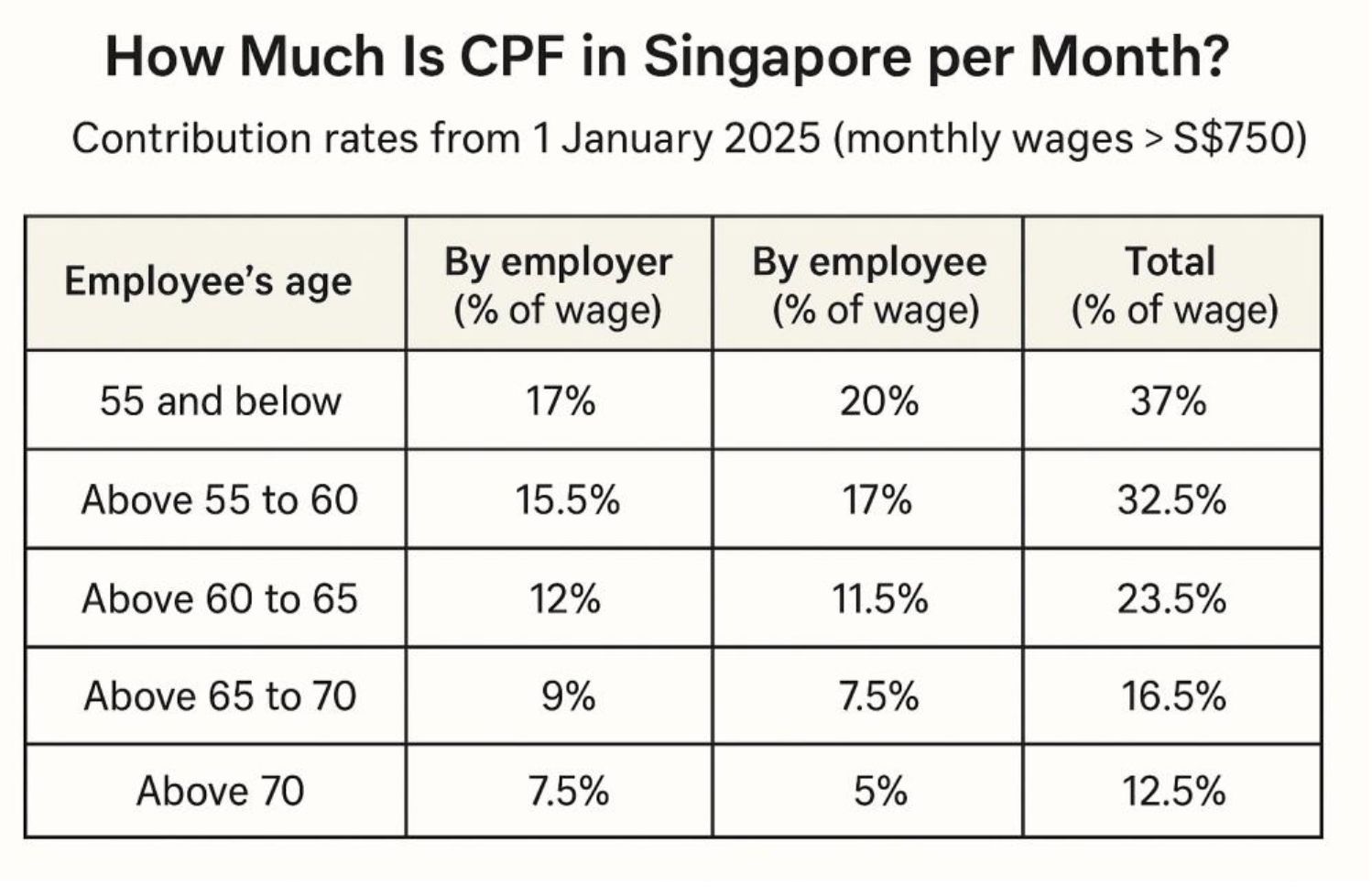

How much is CPF in Singapore per month?

For eligible employees earning more than S$750 per month, CPF contributions range from 12.5% to 37% of monthly wages, split between employer and employee.

The rates are grouped according to the employee’s age.

For example, if your monthly salary is S$6,000, your total CPF contribution is S$2,220, with S$1,020 from your employer and S$1,200 from you.

For expats who become PRs, lower contribution rates apply during the first two years to ease the transition. However, the employer and employee may jointly opt to contribute at full rates earlier.

What happens to your CPF when you turn 55 years old?

At age 55, your Retirement Account is created, combining savings from your Ordinary Account and Special Account.

A Full Retirement Sum, currently around S$213,000 in 2025, is set aside to provide monthly payouts later.

What happens to my CPF when I turn 65 years old?

From age 65, you can start receiving monthly payouts from your Retirement Account through CPF LIFE, Singapore’s lifelong income scheme.

In 2025, retirees can receive more than S$1,000 per month, depending on their CPF savings.

How much will I get from CPF when I retire?

When you retire, your CPF LIFE monthly payouts are determined by the savings in your Retirement Account.

The actual amount is influenced by:

· Total CPF balance

· The plan you choose: Basic, Standard, or Escalating

· Prevailing interest rates declared by the CPF Board

CPF Life Plans

- Basic plan: Lower monthly payouts, higher bequest.

- Standard plan: Balanced payouts and bequest.

- Escalating plan: Payouts start lower but increase 2% annually.

These payouts are for life, ensuring lifelong monthly income in retirement.

What happens to CPF if you leave Singapore?

If you renounce your PR status and leave Singapore permanently, you can withdraw your entire CPF savings in one lump sum. This includes all employer and employee contributions plus accrued interest.

However, once withdrawn, you’ll no longer be covered under Singapore’s retirement or healthcare schemes.

Can I withdraw money from my CPF?

Yes, but only under specific conditions.

You can withdraw your CPF funds:

· When you turn 55 years old.

· If you leave Singapore permanently and renounce PR status.

· For approved uses, such as buying property, paying for education, or medical expenses.

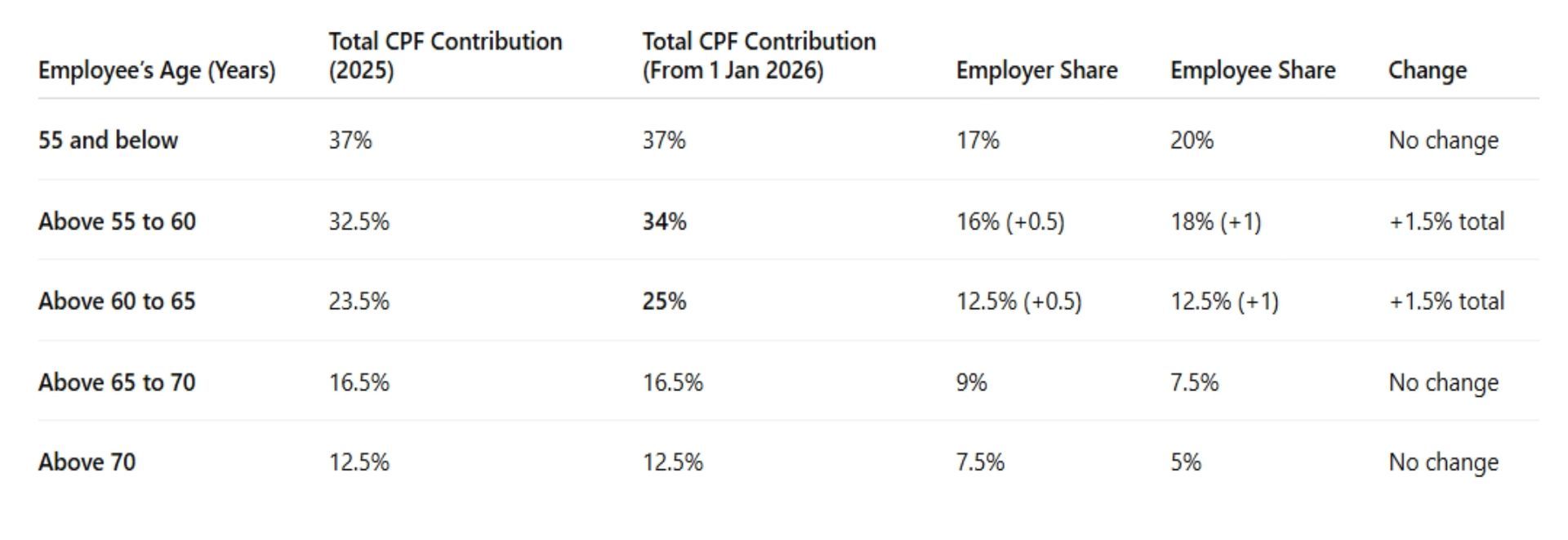

What are the changes in CPF 2026?

From 1 January 2026, the CPF contribution rates for employees aged between 55 to 65 will increase again to further boost retirement savings for senior workers.

The changes apply to monthly wages above S$750 and are part of Singapore’s ongoing plan to gradually align older workers’ CPF rates with younger employees.

FAQS – Frequently Asked Questions.

Can Singaporeans opt out of CPF?

No. CPF is mandatory for all Singapore Citizens and PRs. You cannot opt out unless you renounce your citizenship or PR status.

What happens if you exceed the CPF annual limit?

The CPF Annual Limit for 2025 is S$37,740.

If your contributions exceed this cap, the excess will be refunded to your employer and/or you, depending on who made the extra contribution.

What are the biggest retirement mistakes?

Some of the most common CPF-related retirement mistakes include:

· Not planning for CPF withdrawals and payouts early

· Failing to top up CPF voluntarily to enjoy tax relief and higher interest

· Ignoring CPF LIFE options, resulting in lower lifetime income

Proper planning ensures you maximize CPF interest and payouts, whether you’re a local or an expat transitioning to PR status.