Discover what the Nvidia stock split means for investors and why Nvidia stock is a strong buy right now

Nvidia, the dominant chipmaker, split its stock on Monday morning, June 10, 2024, with shares starting to trade at about $120 from $1,200. But who is Nvidia Corporation, what does it do, and how long has it existed?

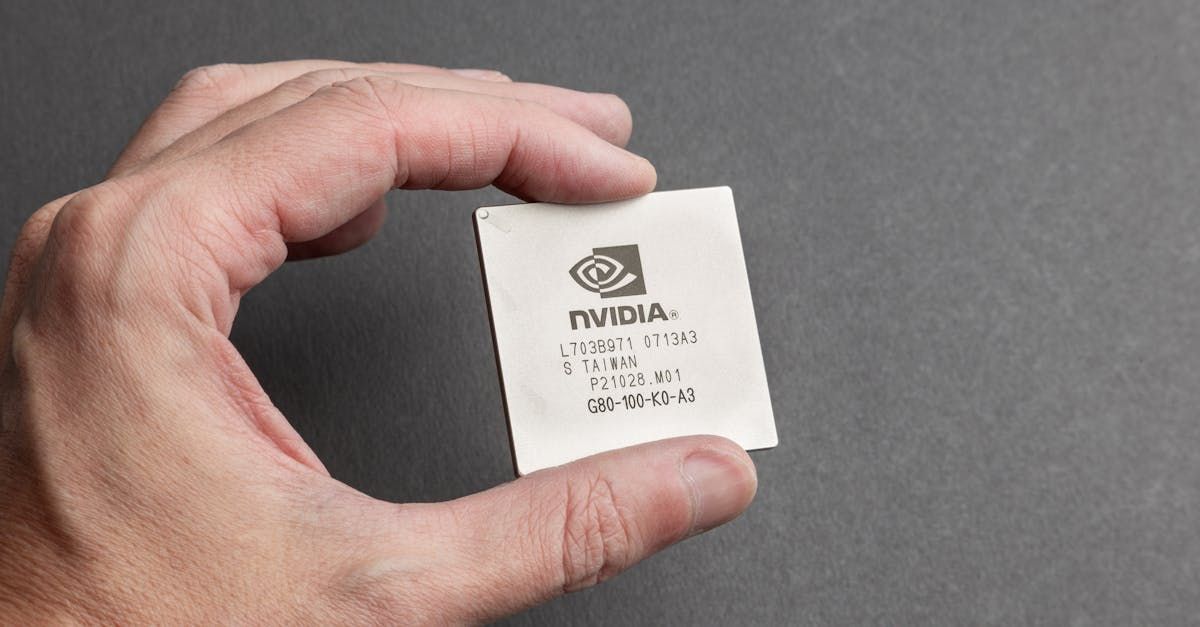

Nvidia Corporation is an American multinational corporation and technology company that was founded on April 5, 1993, by Jensen Huang and two other key innovators. It went public on January 22, 1999. The company specializes in designing and supplying cutting-edge technology for various industries, including graphics processing units (GPUs), application programming interfaces (APIs) for data science and high-performance computing, and system-on-a-chip units (SoCs) for the mobile computing and automotive market. Nvidia is a leading provider of artificial intelligence (AI) hardware and software.

Nvidia’s professional line of GPUs is widely utilized in various industries, including architecture, engineering and construction, media and entertainment, automotive, scientific research, and manufacturing design. These GPUs are specifically designed for edge-to-cloud computing and are commonly found in supercomputers and workstations. In the second quarter of 2023, Nvidia dominated the discrete desktop GPU market with a market share of 80.2%. The company is also a significant player in the gaming industry.

By 2023, Nvidia had achieved a remarkable milestone, joining the elite group of U.S. companies valued at over $1 trillion. Fast forward to June 2024, and Nvidia now holds the position of the world’s second most valuable publicly traded company, just behind Microsoft, with a staggering market capitalization exceeding $3 trillion. This achievement is a testament to the high demand for Nvidia’s processors among companies involved in the development of artificial intelligence (AI). Several investment sources are predicting that Nvidia will reach a market value of $4 trillion by the end of July 2024.

Currently, as per Zank’s ranking, NVIDIA holds the top position as a Strong Buy, with an impressive Growth Score of A and a Momentum Score of B. Stocks with a Zacks Rank number one Strong Buy and a solid growth score of A have consistently outperformed their peers in various market conditions.

Nvidia has proven to be a lucrative investment option over the past few years. The stock price of Nvidia experienced a remarkable surge, reaching approximately $1,200 per share. This impressive growth of 287% can be attributed to the company’s exceptional performance in the May 2023 earnings report, which sparked a widespread interest in generative AI technology. It’s worth mentioning that Nvidia holds a dominant position in the AI industry, boasting an impressive 80% market share in AI chips for data centres. It has led to substantial investments from major cloud vendors, amounting to billions of dollars.

NVIDIA has been leading the charge among technology companies in incorporating AI into their products and services. The CEO of NVIDIA, Jensen Huang, expressed his belief that a new era of industrial revolution has commenced. “The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centres to accelerated computing and build a new type of data centre — AI factories — to produce a new commodity: artificial intelligence.”

Last week, the AI chipmaker introduced an upgraded version of its Blackwell chip, known as the Blackwell Ultra. This powerful chip will be released in 2025 and will be followed by the launch of a new AI chip platform called Rubin in 2026. In 2027, the company plans to introduce an upgraded version of Rubin called the Ultra. The first Blackwell processors are scheduled to be delivered later this year, replacing the highly acclaimed Hopper generative AI chips.

Although NVIDIA’s GPUs remain unparalleled for training AI models, Advanced Micro Devices and Intel are making significant strides in developing their own AI chips, intensifying the competition in this field. NVIDIA is also facing growing competition from its customers, including Amazon, Google, and Microsoft. These companies are working to decrease their dependence on NVIDIA chips in order to lower their capital expenditures. Nevertheless, it will require some time for these companies to establish a significant presence in the market.

Many Innovest Global Wealth clients have raised this question: What do you think will happen to Nvidia Corporation stock after the Stock Split? Fortune favours the bold, and we are pleased to announce that Monday, June 10, 2024, brought great news for current and prospective investors in Nvidia Corporation stock.

The stock split is an important perk for all investors, and here’s why:

NVIDIA made a significant announcement of a 10-for-1 stock split on Monday, June 10 2024. Each investor received an additional nine shares for every NVIDIA share they owned once the split was finalized. Therefore, stockholders of NVIDIA were able to acquire a greater quantity of shares at more affordable prices. The stock split has made Nvidia’s shares accessible and affordable to a broader group of investors.

During a stock split, the company decides to increase the number of shares available, which in turn leads to a reduction in the share price. Nevertheless, the overall monetary worth of all shares outstanding remains unchanged and has no impact on the company’s valuation.

The stock split is expected to open up opportunities for NVIDIA to be included in the Dow Jones Industrial Average, similar to Amazon’s recent addition to the index following its stock split in June 2022.

Following the stock split, Nvidia’s closing price on June 11, 2024, stands at 120.91. Well, the stock price forecast from various investment experts and sources is as follows:

| Year | Prediction/Forecast | Change% |

|---|---|---|

| 2025 | $210 | 80% |

| 2026 | $380 | 224% |

| 2027 | $701 | 485% |

| 2028 | $1,275 | 955% |

| 2029 | $2,299 | 1,801% |

| 2030 | $4,144 | 3,327% |

Before markets open on June 12 2024, the price is 120.91.

Therefore, consider investing $50,000 in purchasing 413 shares of Nvidia today. By holding onto these shares for the next five years, you could potentially see significant growth in your investment, reaching a value of $1,713,671 by 2030.

Similar to any other asset, the price movement of NVIDIA stock is influenced by the forces of supply and demand. Various fundamental factors, including earnings announcements, new product launches, acquisitions and mergers, and other relevant factors, can shape these dynamics. Multiple factors can impact the NVIDIA stock price, including market sentiment, broader economic conditions, interest rates, inflation rates, and political developments.

Still, Innovest Global Wealth customers are curious about the reasons behind the optimistic and bullish forecast.

Forbes highlights three key factors that have been driving Nvidia’s growth, in addition to the strong demand for its chips in the sovereign AI sector.

Impressive first-quarter results and forecast that exceeded expectations: According to Yahoo! Finance, Nvidia exceeded revenue growth expectations by $1.78 billion in the first quarter of the company’s fiscal year 2025, representing a remarkable 237% increase. Additionally, they reported a gross margin of 78.4%, which surpassed initial projections. The company also projected an impressive 197% increase in revenue for the current quarter, exceeding the expectations of analysts, as reported by the Journal.

Nvidia’s investments for future growth: Nvidia’s ambitious rate of new product launches is set to fuel future growth. Blackwell chips, according to Huang, are expected to bring in significant revenue for Nvidia in 2024. Additionally, I mentioned in May that the company’s InfiniBand line is experiencing rapid growth. Nvidia’s impressive 427% surge in revenue from cloud service providers, amounting to a staggering $22.6 billion, as reported by the New York Times, may face potential deceleration in the coming times. Given Huang’s role as the CEO of Create The Future and our previous discussion in Brain Rush, it is evident that Nvidia’s growth can be sustained through a continuous flow of new growth investments.

Jensen Huang’s exceptional leadership abilities: Huang stands out among a select group of extraordinary individuals who possess the remarkable ability to establish, make public, and retain authority over their organization as the CEO for over three years following the IPO, as highlighted in my May Forbes column. His exceptional skill in capitalizing on emerging market trends and effectively promoting top-of-the-line GPUs is precious. Nvidia’s impressive growth hinges on the current CEO’s continued leadership and the eventual selection of a successor who possesses the same level of talent as Huang.

At Innovest Global Wealth, we firmly believe that Nvidia Corporation’s solid projected earnings will be a major driving force, alongside the three facts mentioned, for the performance of the Nvidia stock.

Nvidia announced impressive projected first-quarter fiscal 2025 results, surpassing expectations for both earnings and revenue. The impressive results will be fueled by the soaring demand for NVIDIA’s electric circuits, specifically its graphics processing units (GPUs), and data centres. Record-breaking revenues of $22.6 billion were achieved in the Data Centre sector, with a remarkable year-over-year increase of 427%. This exceptional growth can be attributed to the robust and rapidly growing demand for generative AI training and inference on the Hopper platform.

Anticipating a solid performance, the graphics chipmaker has projected a revenue outlook of approximately $28 billion, with a slight margin of error of 2%. Nvidia Corporation is projected to become a 4 trillion dollar company by the end of July 2024.

Investing is a journey filled with both risks and rewards. Before you decide to invest in any option globally, it is crucial to ensure that the risks are in line with your personal risk appetite. At Innovest, we strongly believe in empowering our customers with a comprehensive understanding of the risks associated with each investment. Our approach, known as the Innovest Wealth Way, focuses on three strategies that aim to align your financial life with your actual life. Our focus is on three key strategies: Liquidity, Longevity, and Legacy. Investing in Nvidia Stock exemplifies a prudent approach to our Longevity investment strategy.

Reach out to us for guidance on how to buy the Nvidia Stock or any other product.

info@innovestglobalwealth.com or nelson@innovestglobalwealth.com